The rays of light within credit markets are slowly growing. Known as Rising Stars, companies moving from high-yield or “junk” to investment-grade status are increasing across many sectors.

According to the latest consensus credit data from Credit Benchmark, which tracks collective credit quality estimates of lenders to firms in various sectors, the total number of new Rising Stars has increased by 24 since the previous update.

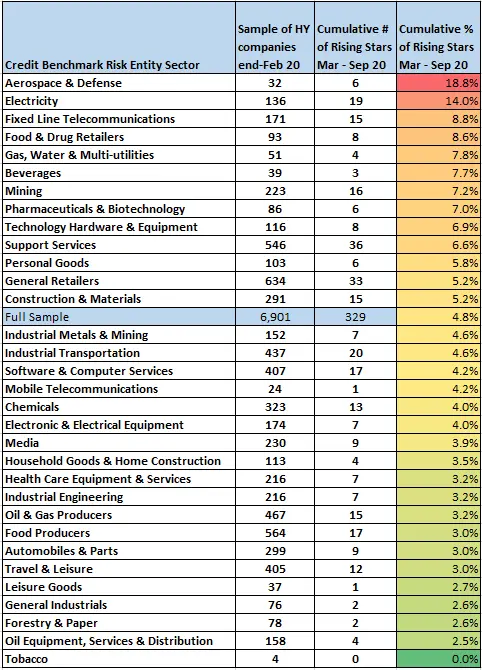

Each month, Credit Benchmark tracks a global sample of corporations across all sectors to gauge the percentage of firms that have improved to investment-grade status. This month’s report captures consensus credit data for 6,901 companies that were classified as High Yield as at end-Feb 2020 and finds that since that time, 329 (about 5%) have migrated into Investment-grade, based on the internal risk views of over 40 leading global financial institutions. Of the 32 sectors examined, 13 have a higher percentage of Rising Stars than the average for the full sample.

Once again, Aerospace & Defence has the highest percentage of Rising Stars at 19%, followed by Electricity at 14%. Each of those sectors saw their percentages grow. Fixed Line Telecommunications is in third at 9%.

Some sectors, like Food & Drug Retailers at 9% and Beverages at 8%, saw their percentages stay the same.

Many sectors, however, experienced improvement. Gas, Water & Multi-utilities improved to 8%, while Support Services improved to 7%. Industrial Transportation now has 5% of constituents as Rising Stars.

As previously stated, positions in some sectors reflect underlying strength in credit quality. Health Care Equipment & Services is one such sector. Already skewed towards investment-grade names, it is less likely to see notable volatility from update to update. But even some sectors whose credit quality is also strong are seeing improvement.

Of course, more thorough improvement across multiple sectors will be harder to come by until a broader economic recovery takes hold. Credit difficulties are certainly not isolated. Airlines have been ravaged by COVID, with thousands of jobs already cut and more possibly on the way. Such distress affects multiple firms, from those in the energy sector to those in the travel and leisure space.

For now, at least, some sectors are moving in the right direction.